People Believe These Things Can Save Them Money but Actually Cost Much More

We all enjoy a good bargain, but occasionally saving money results in paying more than we had anticipated. Continue reading to uncover typical purchases that promise savings but covertly deplete your wallet, ranging from alluring bulk purchases to cunning subscription traps.

Bulk Buys That Go Bad Before You Use Them

Purchasing in bulk seems like a good idea - until half of the cupboard goes bad. That enormous mayo tub? Now, it's a biohazard! Bulk purchasing can stealthily deplete your wallet and clog your shelves - unless you have a large home and family, of course!

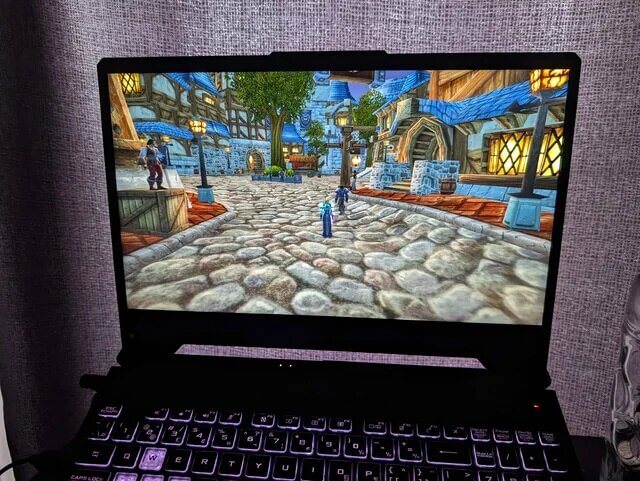

Cheap Tech That Breaks Too Soon

Before it froze, shattered, and refused to charge, that cheap tablet appeared promising. Cheap devices frequently lack longevity, so you'll need to replace them sooner than you think. You can avoid the hassle (and expense) of frequent replacements by investing a little more up front.

DIY Fixes That Cost More Than A Pro

It seems simple to fix a leaking tap - until your "quick job" floods your entire kitchen. Although DIY can feel empowering, it often results in higher expenses if you lack the necessary equipment or expertise! So, all in all, it would simply be best to hire a professional in the first place!

Discounted Clothes You Never Wear

That half-price jacket felt like a bargain at the time, but now it just sits unworn - collecting dust. We are tempted by "what ifs" on sale racks, but impulsive purchases rarely turn into wardrobe mainstays. So, the lesson learned is that even though it seems like a great deal, all it ends up being is clutter and a waste of money!

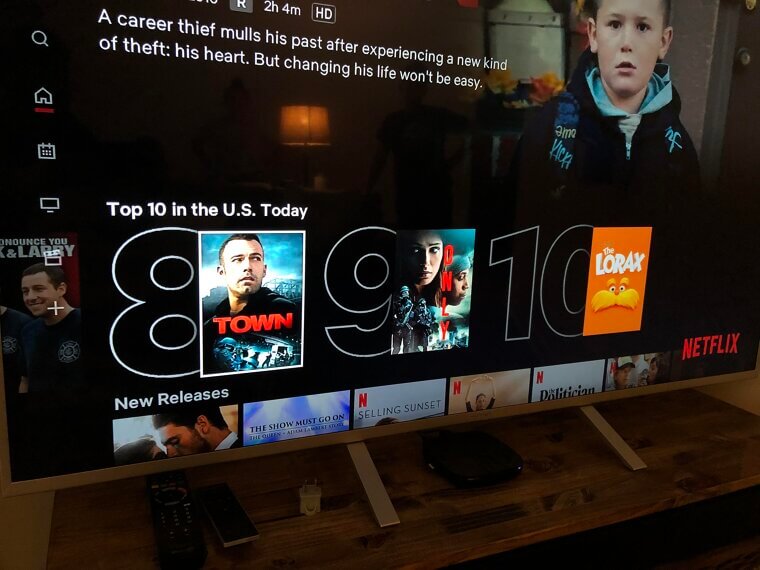

Subscription Deals You Forget To Cancel

Free trials are fantastic, but they covertly renew for months after that. Forgotten subscriptions eat away at your spending, from fitness applications to streaming services. You may avoid these hidden, slow-drip costs by using an app audit or even a calendar reminder.

Low-Cost Cars With High Repair Bills

That cheap car you thought would last a lifetime always ends up causing your local repair shop to be your second home. Older cars can conceal expensive problems behind a glossy veneer - so be careful!

Budget Travel That Adds Hidden Fees

Cheap flights often come with surprise charges - baggage, seat selection, even snacks. That "deal" can quickly get out of hand. You can avoid the sting of unforeseen add-ons by reading the fine print and comparing overall costs, not just ticket prices!

Home Energy Gadgets That Don’t Deliver

Despite their promises, plug-in miracle devices rarely result in cheaper bills. Some devices, including "power-saving" plugs and dubious insulation tricks, end up costing more than they save; therefore, it’s best to avoid them.

Store Brands That Don’t Work As Well

Generic goods can seem great - until they don't meet expectations. Poor performance results in double usage or replacements, whether it's cling film that won't stick or detergent that doesn't clean.

Coupon Purchases You Didn’t Really Need

Although coupons make us feel good, they frequently encourage us to make unplanned purchases. That offer of "buy two, get one free"? Only if you needed two anyway would it be helpful; so don’t waste your money!

Sale Items That Sit Unused

Sure, clearance racks give you a sense of excitement - but whatever you buy is likely to end up collecting dust! Purchasing something just because it's inexpensive rarely works out, whether it's hobby materials or kitchen appliances.

Extended Warranties That Rarely Pay Off

Although most products never require extended warranties, retailers love to offer them. But, unless it's a costly item with recognized problems, that additional coverage might just be boosting the profit margin of someone else.

Cheap Furniture That Falls Apart

No one wants a wobbly, warped, and unstable bookshelf; even if it seemed fine at first! Sturdiness is frequently compromised for style in inexpensive furniture. Purchasing high-quality items, even if they’re used, will help you avoid having to replace them frequently.

Meal Kits That Cost More Than Cooking

Although meal kits are convenient, they are often more expensive per serving than preparing at home. Using them daily can subtly increase your food expenditure, so a small amount of preparation in the kitchen is certainly beneficial.

Finance Plans With Hidden Interest Rates

The "buy now, pay later" option immediately lures customers into making a purchase. It sounds great, until interest skyrockets faster than you can imagine! Plans for deferred payments often conceal hidden costs or exorbitant rates that quickly accumulate (so it’s best to avoid them altogether).