These Small Money-Saving Habits Can Help You Save Big Each Year

Saving money doesn’t have to mean huge sacrifices or living on instant noodles. Sometimes it’s the tiny habits, the ones you barely notice, that end up making the biggest difference. Ready to see where your wallet’s been leaking? Let’s get started.

Brew Coffee at Home

Your daily latte may not seem like that big of a deal, but the five dollars here and there quickly add up to over $1,000 each year. Brewing coffee at home costs pennies per cup. With a good travel mug, you'll hardly miss the barista. You might miss their latte art, though.

Pack Your Lunch

Eating out for lunch is sneaky expensive. Even a modest $10 meal five days a week runs you $2,600 a year. Packing leftovers or a homemade sandwich not only saves you money but probably cuts calories, too.

Cancel Forgotten Subscriptions

Those "set it and forget it" subscriptions of $5, $10, or $15 can really sneak up on your wallet. You may have subscriptions to several streaming platforms, fitness apps, and digital magazines, and these can really add up. Cancel the subscriptions you hardly use, and you just might feel like you got a raise without changing jobs.

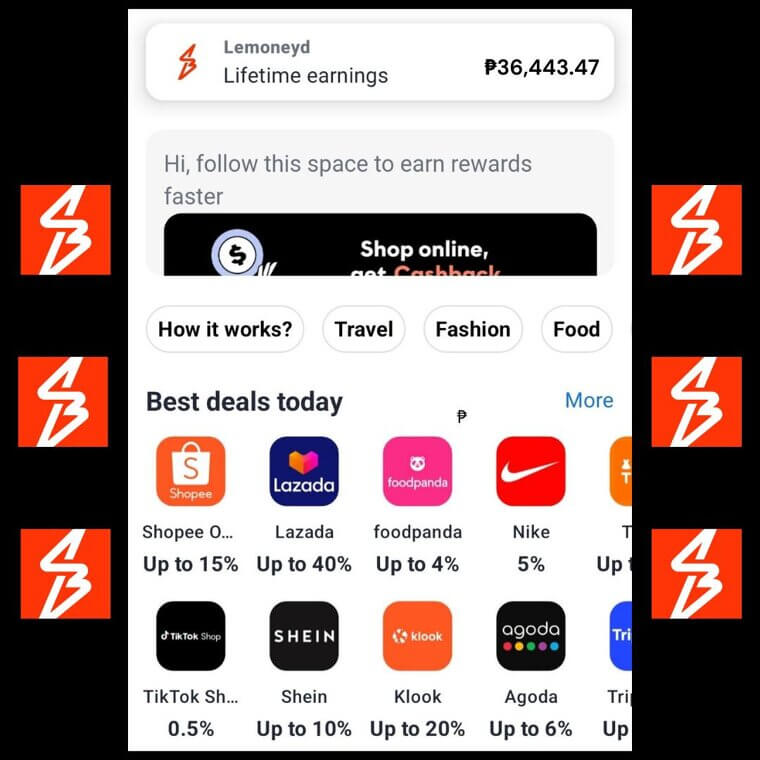

Use Cashback Apps

If you’re going to shop, why not make your money work double? Cashback apps and browser extensions can give you back a small percentage each time you buy something. A percent here and another five there may not make you a millionaire overnight, but every little bit adds up and can turn into hundreds of dollars in a year.

Switch to Generic Brands

Name-brand cereal, meds, and cleaning products love to charge you extra for fancy packaging. Generics are often the same formula, sometimes even made in the same factory, without the logo tax. Switching on just a handful of staples each week can free up serious cash with zero sacrifice in quality.

Automate Savings Transfers

Out of sight, out of mind works wonders with money. Set up an automatic transfer into savings, say $25 a week. You won’t even notice it’s gone, but at the end of the year, that’s $1,300 waiting for you. It’s like tricking yourself into having future spending money.

Ditch Bottled Water

A bottle here, a bottle there, and before you know it, you’ve spent $400 a year on something that comes out of your faucet. Get a reusable bottle and a decent filter if you’re picky. It’s good for your wallet and the planet. Win-win, no plastic guilt attached.

Buy in Bulk (Strategically)

Warehouse clubs are tempting with their 10-pound cheese wheels, but bulk shopping works best with nonperishables like rice, beans, and toilet paper. Buying in bulk saves per unit, and fewer trips means less temptation for impulse snacks. Just don’t stockpile 50 rolls of paper towels unless you’re planning for the apocalypse.

Skip the ATM Fees

Paying $3 every time you hit an out-of-network ATM is like tipping the machine for existing. Do that once a week, and you’ve thrown away $156 a year. Stick to your bank’s network or get cash back at checkout. That $3 should be buying tacos, not air.

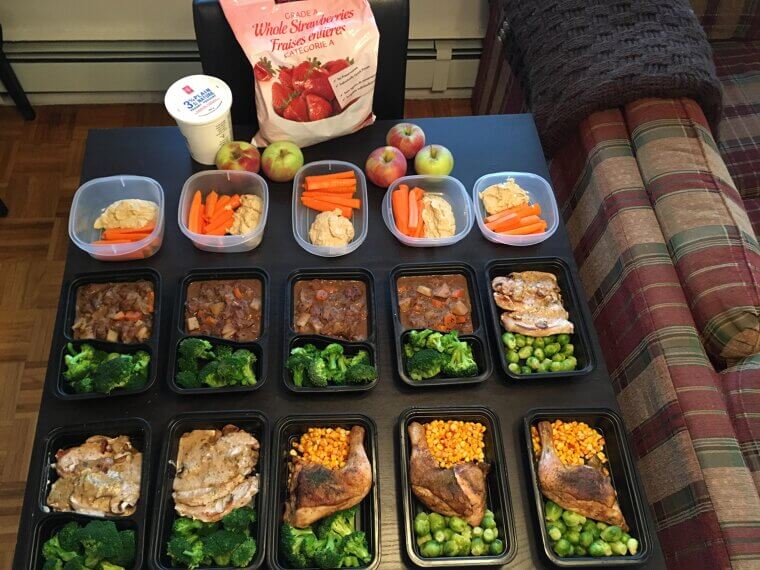

Meal Plan Like a Pro

Winging it with groceries almost guarantees wasted food and last-minute takeout. Planning weekly meals means buying only what you’ll actually eat, which cuts waste and slashes impulse spending. Even shaving $20 a week off your food budget adds up to over $1,000 by year’s end.

Cook More at Home

Takeout is fun until you realize your wallet’s crying. Cooking at home isn’t just cheaper, it’s healthier too. It’ll help you save cash, and you’ll probably impress yourself with how good your pasta sauce turns out compared to the soggy stuff from delivery.

DIY Gifts Instead of Buying

Homemade is better than store-bought in terms of charm and cost. Instead of spending $50 on some generic gift, spend a few bucks on supplies or ingredients. People love the personal touch, and you'll save some money. It's a win-win!

Go Meatless Once a Week

Meat is tasty, but it’s also one of the most expensive items on your grocery bill. Consider a meatless Monday. Beans, lentils, or veggie stir-fries can be filling, nutritious, and cheap.

Set Spending “No-Buy” Days

Select a couple of days each week where you commit to spending no money; no takeout, no impulse purchases, nothing. This may sound small, but not doing those "just one thing" purchases can add up to hundreds of dollars in a year.

Take Public Transit

Honestly, gas prices and parking fees can make driving feel like highway robbery. Although public transportation is not always known for comfort, it is often affordable and environmentally-friendly. You also get an opportunity to catch up on podcasts instead of expressing road rage.

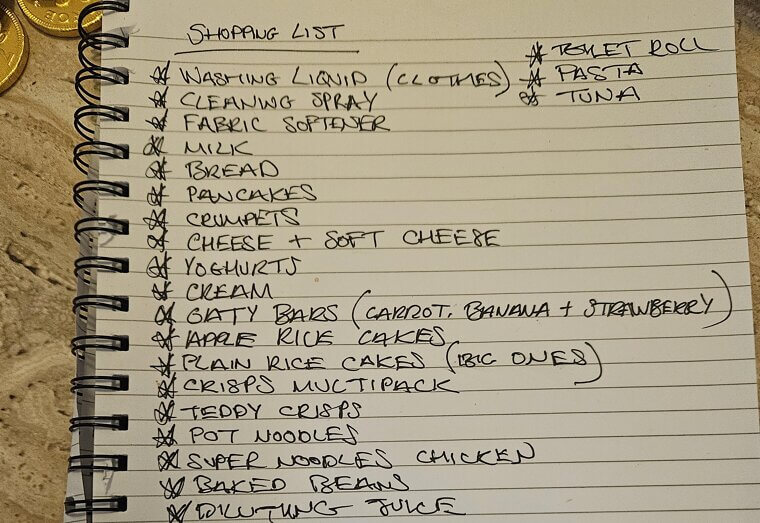

Make a Shopping List (and Stick to It)

Walking into a store without a list is basically an invitation to overspend. A list helps you stay laser-focused and saves you from random things you don't need. Consider it your financial GPS, safely navigating you out of budget madness.

Trade Clothes With Friends

Instead of spending tons of money on new outfits for every occasion, organize a clothing swap. You'll refresh your closet for free, hang out with friends, and clean out your closet at the same time. It's pretty much retail therapy, without the retail or therapy bill.

Cook Once, Eat Twice

Making big batches of food isn’t just for college kids. Leftovers save money, time, and your sanity on busy nights. Roast a chicken, turn it into tacos the next day, then soup on day three. It’s budget wizardry disguised as meal planning.

Negotiate Your Bills

You can negotiate with your cable provider, phone provider, and even your insurance. Just call them and ask for a cheaper rate; they would rather reduce the rate than lose you as a client. It can feel a little awkward for five minutes, but it could save you hundreds per year.

Skip the Dryer

Your dryer uses a lot of electricity. Line-drying clothes, whether indoors or outside, saves money, helps clothes last longer, and cuts down your bills. You may not think it’s glamorous, but nothing smells better (or lasts longer) than sun-dried laundry.

Don’t Upgrade When You Don’t Need To

Do you really need that new phone when your phone is working perfectly? Upgrades can burn a hole in your pocket quickly. When you stretch the life of your electronics, cars, and appliances, you’re putting hundreds of dollars back in your pocket.

Thrift for Clothes

Retail prices are for the impatient. Thrift stores, consignment shops, and even online resale apps have stylish items for a fraction of the price. There’s a good chance you will find some vintage gems while you are keeping clothes out of landfills,

Cancel That Gym You Don’t Use

If your visits to the gym are as rare as a solar eclipse, it's time to cancel. Walking, YouTube workouts, and resistance bands are all free. It’s not "just $30 per month;" those charges add up over time. Before you know it, you've spent $360 a year for a treadmill you haven't used since you made that New Year's resolution.

DIY Cleaning Supplies

Vinegar, baking soda, and lemon juice can clean pretty much anything in your home for practically nothing. Rather than spending $6 on a specialty spray, a $1 bottle of vinegar does the job. You'll save money and avoid having cabinets stuffed with half-used products.

Skip the Impulse Buys Online

Those “People also bought” suggestions can be financial traps. Add it to your cart, but walk away for 24 hours. Nine times out of ten, you will realize you don’t need it. Congratulations, you just saved $40 on a cat-shaped waffle maker.

Use Loyalty Programs

It may seem old-fashioned, but grocery and drugstore loyalty programs can add up surprisingly fast. Clip digital coupons, earn cash back, or get a free coffee after 10 visits. Free stuff is far more enjoyable when you realize you didn’t pay anything extra to get it.

Unsubscribe From Temptation Emails

Retailers love to bombard you with “flash sales,” which aren’t really sales at all. Unsubscribe, and your inbox instantly gets quieter and your wallet stays fuller. Nobody needs a fifth pair of sneakers just because they were “40% off today only.”

Use the Library

Why spend $20 on a book you’ll read once? Libraries are free treasure chests of books, movies, and even audiobooks. Some even lend out tools or sewing machines. A shopping spree without the checkout total. How wonderful!

Borrow Rather Than Buy

How often do you actually use a power drill, ladder, or waffle maker? Borrow from a neighbor, friend, or a tool library. This not only saves you money and storage space, but it also means less dusting of items you never use.

Turn Chores Into Workouts

Skip the gym and let yard work, cleaning, or DIY projects double as exercise. Why pay for a treadmill when mowing the lawn burns the same calories? You’ll save on a membership and check off to-dos at the same time.

Repurpose Instead of Replace

Before buying something new, ask: “Can I fix it, tweak it, or repurpose it?” A ripped shirt becomes a cleaning rag, glass jars become storage containers, and an old ladder? Instant rustic bookshelf. You’re saving money while you’re giving your stuff a second life.

Sell Your Clutter

If it’s collecting dust, it’s probably worth money. Old gadgets, clothes, or furniture can be flipped on Facebook Marketplace, eBay, or Poshmark. You clear your space, and your wallet gets a refill.

Ditch Paper Towels

Paper towels are convenient, but they’re money you throw in the trash. Switch to washable cloths, and suddenly you’re not restocking paper products every grocery trip. Small change, big savings.

Use Community Swaps

Neighborhood “buy nothing” groups and swap meets are gold mines. You can snag furniture, kids' clothes, and even electronics for free. Think of it as extreme couponing without the scissors.

Grow Your Own Herbs

Fresh basil, cilantro, and mint are grocery store wallet traps. A tiny $3 starter plant on your windowsill pays for itself after one meal. Besides, nothing feels fancier than snipping your own herbs into dinner.