Plan Ahead by Knowing the Right Savings for Comfortable Retirement Living

Retirement sounds nice. Beaches, golf carts, and finally telling your alarm clock to take a hike. But how much do you really need to save? Well, the answer’s not that simple. There isn't one magic number. The amount you'll need to save is going to be dependent on your lifestyle, health, and a few surprises.

Your Lifestyle Dreams

When you think of retirement, do you think of lounging on a beach chair with a margarita or gardening with your grandchildren in the backyard? Your budget depends on your dream lifestyle. So, be honest, a fantasy yacht or a cozy cabin? Your bank account needs to know before it’s too late.

Housing Costs

Still paying off that house? That’s a big part of your monthly budget. Moving into a smaller home, renting, or keeping the family home can all impact the savings math. Even a “paid off” house will still drain cash through property taxes, insurance, and maintenance.

Cost of Healthcare

Retirement may involve doctor appointments, prescriptions, and maybe an unexpected surgery or two. Medicare helps, but it may not be adequate. Out-of-pocket health care expenses can quickly add up, so it’s best to have a good cushion for health care expenses.

Inflation

The $0.25 cup of coffee your grandmother paid for then is now a $5 latte. Inflation is like a midnight snack monster that gobbles away at the money you saved for retirement. That huge nest egg you think you have today? It's not going to be worth as much in 20 years. Never make a plan without anticipating inflation, it's the ultimate unwanted guest!

Long-Term Care

Nursing homes and assisted living aren’t exactly cheap. Most people don’t like thinking about it, but planning for long-term care is huge. Without it, one health crisis can eat through decades of savings. Better to plan ahead than let your nest egg vanish faster than dessert at Thanksgiving.

Travel Plans

For many people, "see the world" is at the top of their retirement goals. If that is you, you had better start topping off that savings account. Because airline tickets, hotel accommodations, and cruise buffets are not going to pay for themselves. Even domestic travel can add up.

Debt Status

Retiring with debt is like running a marathon with ankle weights; you can do it, but it is so much more difficult. Student loans (yes, they still haunt some folks), credit cards, or even car payments can eat into your savings. The less debt that you have going into retirement, the more free money you will have.

Social Security

Social Security is the government’s way of giving you back a slice of your paycheck. But it won’t cover everything. Think of it as your retirement sidekick, not the superhero. Knowing how much you’ll actually get helps set the baseline for how much more you need saved.

Hobbies and Fun

Retirement isn't just about factors of maintaining the bills; it's also about enjoying your free time. And hobbies cost money, from golf memberships and art classes to gardening and pickleball. If your idea of fun involves expensive gear or lessons, plan for it.

Emergency Fund

Life will still throw curveballs your way in retirement. Whether it is car repairs or unexpected medical bills, life has a way of surprising us. An emergency fund will keep you from withdrawing long-term savings too soon.

Family Support

Do you intend to assist the kids with college? Or perhaps, you’ll be the grandparent who puts $20 in every birthday card? Family generosity is wonderful, but it can also be expensive. If supporting your family is part of your plan, include the costs.

Taxes

Retirement does not mean tax-free. Withdrawals from a traditional 401(k) or IRA are taxable. Depending on your income, Social Security can also be subject to tax. Uncle Sam always wants a slice, so make sure your savings plan accounts for the IRS’s not-so-gentle hand in your golden years.

Location

Where you retire is significant. Do you want Florida sunshine, New York energy, or maybe the peace of the Midwest? The cost of living can vary widely between states and cities. Moving to a less expensive area can help preserve your savings, while a high-cost area can deplete them quickly.

Rising Utilities and Bills

Retirement doesn't mean the bills stop. You will still need to pay for electricity, water, internet, streaming subscriptions, and more. In fact, spending more time at home can actually increase your bills. You'll want to have enough savings so you don't feel guilty when watching Netflix.

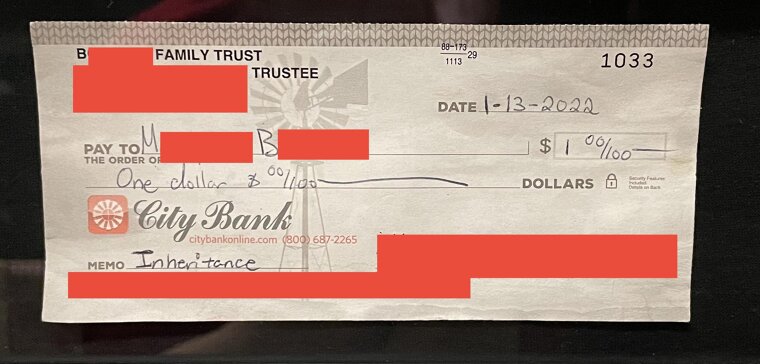

Legacy Goals

Do you want to leave an inheritance, fund a grandchild's college, or donate to your favorite charity? It's time to save more. If you want to leave a mark, your retirement fund is not just for you.